Recent Blog Posts

THE HIDDEN CRISIS: Why 67% of Americans Leave Their Families in Legal Limbo

A staggering 67% of Americans die without a will or estate plan, leaving their assets tied up in court, subject to state intestacy laws, and often creating unintended financial and emotional burdens for their loved ones. Adding to this challenge, probate—the legal process of administering an estate—can take six months to two years and cost 3% to 7% of the estate’s value in legal and administrative fees. The result? Delays, expenses, public records, and potential family disputes that could have been avoided with proper planning.

Important Update on BOI Reporting Requirements

By Steve W. Ledbetter, Esq.

There have been ongoing updates regarding the enforcement of Beneficial Ownership Information (BOI) reporting requirements. In the latest development, the Fifth Circuit Court of Appeals reinstated a lower court's injunction, which temporarily suspends the BOI filing requirement. The court cited the need to preserve the constitutional status quo while a panel of judges reviews the case's substantive arguments.

Estate Planning Checklist for Year-End Financial Planning

By Jada W.Terreros, Esq.

As we approach the end of the year, now is the ideal time to revisit and update your Estate Planning documents. An annual review ensures that your plans align with your current wishes and financial situation. Here’s a checklist to help you stay on track:

Expert Insights: The Risks of Naming Minor Children as Death Beneficiaries in Estate Planning

By Callie W. Cowan, Esq.

When considering how to structure your estate plan, one of the most important decisions you will make is determining who will inherit your assets. If you're a grandparent wanting to leave a portion of your estate to a minor grandchild, it's crucial to understand the potential pitfalls associated with naming them as a direct beneficiary. As an estate planning attorney, I've seen firsthand the complications that can arise from this well-intentioned decision.

Understanding Beneficiary Designations

By Jada W. Terreros, Esq.

As an Estate Planning Attorney, I frequently encounter clients who are unaware of the intricacies involved in beneficiary designations and their interaction with Wills. A common scenario involves clients who believe they have adequately named multiple beneficiaries in their Wills, only to discover later that due to a misunderstanding, they effectively named just one beneficiary. This misunderstanding can lead to significant consequences. Let's delve into the critical aspects of beneficiary designations and how they interact with Estate Planning.

Inherited IRAs: Insights from a Probate Attorney

By Carolyn S. Smith, Esq.

As a probate attorney, it is very common to deal with beneficiary inherited Individual Retirement Accounts (IRAs). Most people have either never heard of a beneficiary IRA or do not understand how they work. In this blog, I would like to offer insights into the legal landscape surrounding inherited IRAs, shedding light on key considerations that beneficiaries should be aware of.

Preparing for Your Parents’ Future (and Yours!)

By Callie W. Cowan, Esq.

As our parents age, we are confronted with the reality that their well-being may someday soon be in our hands. But what documents should we be making sure they have in place? This article will cover three indispensable documents that play a crucial role in proactive estate planning for your parents and future generations.

Securing Your Legacy: The Indispensable Role of an Estate Planning Attorney

By Steve W. Ledbetter, Esq.

Embarking on the journey of estate planning is a pivotal step in ensuring the seamless transfer of your assets and safeguarding the future for your loved ones. While online programs may offer a quick and seemingly convenient solution, there are compelling reasons to choose the personalized guidance of an experienced estate planning attorney. In this blog post, we'll explore why opting for professional legal assistance is essential for creating a robust and tailored estate plan.

Unlocking the Digital Vault: Navigating Digital Assets in Probate

By Carolyn S. Smith, Esq.

In the modern era, our lives are increasingly intertwined with technology. From social media profiles to cryptocurrency wallets, much of our personal and financial information exists in the digital realm. However, what happens to these digital assets when we pass away? This question lies at the junction of technology and probate law, presenting both challenges and opportunities for estate planners and beneficiaries alike.

Why Charitable Giving Should Be Part of Your Estate Plan

By Callie W. Cowan, Esq.

Estate planning isn't just about distributing assets; it's also an opportunity to leave a lasting impact on the causes and organizations that matter most to you. Charitable giving is a noble way to make a difference, even after you're gone. Here are a few compelling reasons why you should consider including charitable donations in your estate plan:

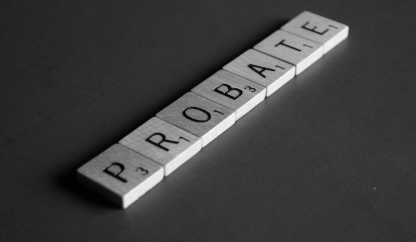

Understanding Probate: Why Your Home May Go Through the Process

By Carolyn S. Smith, Esq.

If you own a home and pass away, your home may go through the probate process if it is part of your probate estate. The probate process is a legal procedure that occurs after someone's death to administer and distribute their assets, including their real estate, according to their will or the laws of intestacy (when there is no valid will).

After Graduating High School - The Importance of Advanced Directives

By Callie W. Cowan, Esq.

High school graduation marks an important milestone in life. As you embark on this new chapter filled with opportunities and independence, it's essential to consider important aspects of responsible adulthood, such as healthcare planning. One crucial component of healthcare planning is creating advanced directives.

Estate Planning for Unmarried Couples

By Steve W. Ledbetter, ESQ.

There are many reasons why a committed couple in a loving relationship might choose not to get married. We strongly recommend that unmarried couples consider the implications of Estate Planning to ensure that their wishes are fulfilled with regards to their testamentary documents. It is also important to consider fiduciary appointments for managing assets and health care in the event of incapacity.

New to Florida? It’s Time to Update Your Estate Plan

By Callie Cowan, Esq.

You’ve made it. You’re finally a Florida resident, enjoying the warmth & sunshine. It has undoubtedly taken a great deal of planning to get to this point, but there is one more piece of planning you may not have considered – your Estate Plan.

What is Probate?

By Carrie Smith, JD

At its most basic, probate is a court process that determines where the assets that were owned by the decedent, the legal term for the person who died, belong. A probate judge oversees the process making determinations based on direction given in a Will or in statute if no Will exists...

So, You Want to Start a Business?

By Steve W. Ledbetter, Esq.

You have a great idea, and your entrepreneurial mind is flowing. How Exciting! Now you want to form a business entity (e.g., Florida corporation or limited liability company) to properly manage your business and insulate from liability. Here are some ideas to think about in the process:

Rights of Spouse – Not Always What You’d Expect

By Steve W. Ledbetter, ESQ.

In the context of Estate Planning, marriage can add many elements of complexity. In fact, in our law practice it is quite common to get to educate new clients on how their recent nuptials may add multiple levels of complexity to their estate plan.

Don't DIY Your Estate Plan

By Callie Cowan, ESQ.

Whether it's Fixer Upper or This Old House, we've all seen projects go awry when homeowners try to "DIY" certain things that should have been left to the professionals.

Unfortunately, we often see people try to take a "do it yourself" approach when it comes to their estate plan and the results can be just as disastrous.